27+ Take Home Pay Calculator Utah

By accurately inputting federal withholdings allowances and. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Utah.

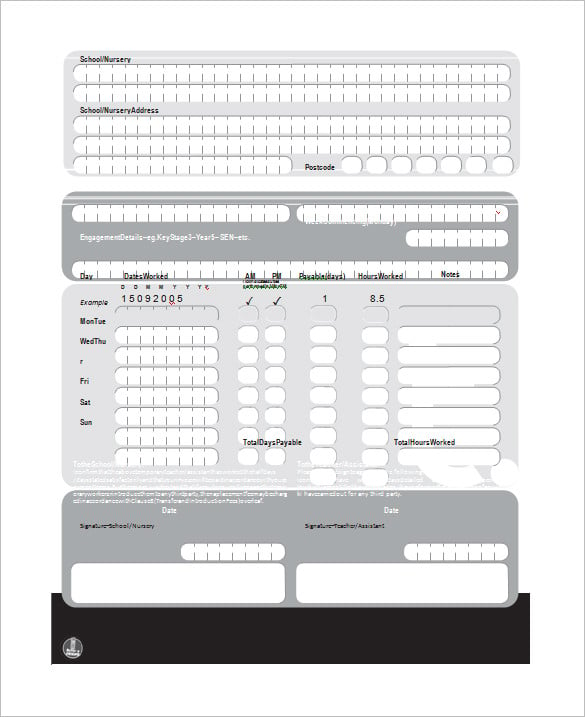

8 Salary Paycheck Calculator Doc Excel Pdf

Web Simply follow the pre-filled calculator for Utah and identify your withholdings allowances and filing status.

. After a few seconds you will be provided with a full. Figure out your filing status work out your adjusted gross. Open an Account Earn 14x the National Average.

Web Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Once done the result will be your estimated take-home pay. That means that your net pay will be 43257 per year or 3605 per month.

Web Calculate your Utah net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Utah. Web Calculating your Utah state income tax is similar to the steps we listed on our Federal paycheck calculator. It can also be used to help fill steps 3 and 4 of a W-4.

Web To use our Utah Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. If you make 100000 a year living in the region of Utah USA you will be taxed 27368. It will figure out your employees gross pay net pay and.

Utah Paycheck Calculator ADP Skip to main content Start Quote. Web Need help calculating paychecks. Well do the math for youall you need.

Web One of the most useful and sought after this paycheck calculator quantifies take-home pay for salaried employees. Web Launch ADPs Utah Paycheck Calculator to estimate your or your employees net pay. That means that your net pay will be 72632 per year or 6053 per month.

Web All you have to do is enter wage and W-4 information for each employee and our calculator will do the rest. Web Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Easy 247 Online Access.

Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Utah. Web How to Calculate Salary After Tax in Utah in 2023 The following steps allow you to calculate your salary after tax in Utah after deducting Medicare Social Security Federal Income. If you make 55000 a year living in the region of Utah USA you will be taxed 11743.

G3jwamjuqf8n4m

Utah Income Tax Calculator Smartasset

27 Content Marketing Statistics To Help You Succeed In 2023

364 Cochrane Mountain Dr Eureka Mt 59917 Mls 22216916 Zillow

Money Jan2017 By Egarel07 Issuu

Free 6 Sample Net Pay Calculator Templates In Pdf Excel

9050 S 1150 W Ln West Jordan Ut 84088 Mls 1852267 Utwfrmls

Free 6 Sample Net Pay Calculator Templates In Pdf Excel

.jpg?width=850&mode=pad&bgcolor=333333&quality=80)

Bria Apartments 3330 West 4000 South West Haven Ut Rentcafe

Bmx Bikes Bmx Parts Bmx Accessories Albe S Bmx Bike Shop

Utah Paycheck Calculator Tax Year 2022

![]()

Free Utah Payroll Calculator 2023 Ut Tax Rates Onpay

Free Paycheck Calculator Hourly Salary Usa Dremployee

Utah Paycheck Calculator Smartasset

Alpine Flats Student Apartments Apartments 729 E 900 N Logan Ut Apartments Com

Calculate Take Home Pay

2023 Gross Hourly To Net Take Home Pay Calculator By State